- Supercool

- Posts

- 🌐 Telling the Future: Climate, Capital, and the Power of Story

🌐 Telling the Future: Climate, Capital, and the Power of Story

The $2 Trillion Energy Revolution Has Already Begun

Molly Wood operates at the intersection of business, technology, and climate. So naturally, we had a lot to talk about.

At Supercool, we believe civilization has entered a new era where the low-carbon economy is accelerating, with or without federal subsidies, rebates, or tax credits.

AI gives buildings brains—to reduce energy, improve comfort, enable preventive maintenance, and save money.

Trash disappears into underground pneumatic tubes—to clean streets, curb noise, improve safety, and cut carbon.

Electric buses optimize school bus routes—to improve health, cut costs, and provide parents, students, and administrators with peace of mind.

Cities recover waste heat from their sewers—to heat and cool homes and offices, lower energy bills, and locally produce zero-emission energy.

Inner city schools eliminate fossil fuels—to boost test scores, improve attendance, lower detention rates, and slash carbon emissions.

The pace and scope of climate innovation are staggering. Amidst so much disruption, it felt like the right time to step back and make sense of what’s happening—and what comes next.

Few people are better positioned to do that than Molly Wood.

For two decades, she covered the biggest trends in business and technology as a journalist at Wired, CNET, The New York Times, and, most famously, Marketplace on NPR. Her voice is instantly recognizable as the show’s occasional host and from the Marketplace Tech report. It accompanied me for years on my evening commute home.

Then, in 2022, she left it all.

Molly walked away from journalism—at the peak of her career—to become a climate tech investor, joining prominent angel investor Jason Calacanis as Managing Director of Launch (then becoming a Venture Partner at Amasia). She saw the clean energy transition not as a beat to cover but as the most important economic and technological shift of our time.

Here’s where it gets even more interesting: two years later, she returned to storytelling.

Molly realized that for climate solutions to scale, people need to understand them. Climate tech isn’t just a science or policy story—it’s a business story. It’s an investment story. It’s a story about opportunity. Telling that story well matters.

So she launched Everybody in the Pool, a climate solutions podcast and newsletter focusing on the companies, the people, the products, and the business of solving the climate crisis.

That’s why she’s on Supercool this week—we had a lot of notes to compare.

The Future of Energy: Fusion, Batteries, and Homes as Power Plants

We started with nuclear fusion—the ultimate climate technology. Not because it’s here yet, but because it’s shockingly close (see more below).

Fusion is the holy grail: unlimited, carbon-free energy that could make fossil fuels obsolete. It could power heavy industry, solve desalination, and provide cheap green hydrogen at scale. Every sci-fi future assumes fusion is solved—and now, we’re on the verge of making it real.

Fusion companies don’t even call it "nuclear fusion" anymore—they’re branding it as “fusion energy” to avoid public hesitation, akin to one of the most advanced machines the medical field uses to diagnose patient conditions.

“It’s like MRI machines,” says Molly. “MRI is nuclear technology, but we don’t say, ‘Hey, go get in the nuclear imaging resonance machine!’ because no one would do it.”

But fusion is still a long-term play. As you’ll hear on the podcast, the biggest shift in energy is happening at home.

Homes as Mini Power Plants

Right now, the race is on toward decentralized energy.

Molly calls it “bring your own power.” Solar, batteries and bidirectional EVs mean homes are no longer just passive consumers of energy—they’re becoming part of the energy grid.

This shift is massive. Utilities know they need our assistance because they can’t meet the rising demand alone. Consumers are increasingly aware of these dynamics.

As we discussed in last week’s newsletter with Dan Lotano, COO of GoodLeap, at some point, people will know the price of a kilowatt-hour the same way they track the price of a gallon of gas at the pump. Different than gasoline for your car, a one-way expense, home energy will become a two-way intersection, an expense to be sure, but also a revenue opportunity.

That shift is fueling the rise of Virtual Power Plants (VPPs)—networks of homes and businesses acting as a collective energy source. But the picture isn’t yet completely filled in.

The Missing Financial Link: Plaid for Energy

Molly made an interesting analogy: what VPPs need is the clean energy version of Plaid.

Plaid, if you’re unfamiliar, is the fintech company that makes it seamless to connect your bank account to apps like QuickBooks, Robinhood, or Venmo. It’s the popup that appears on your screen, prompting you to log in to your bank, check a few permission fields, and then, presto! Your financial transactions proceed seamlessly.

Before Plaid, this process was cumbersome. Now, it’s so smooth you don’t even think about it.

Households may need the same thing—a seamless financial layer that allows them to easily buy, sell, and monetize the energy flowing on and off their meter.

Companies like Nest (now RenewHome) are doing early versions, working with utilities to offer energy-saving incentives. Sunrun and Enphase are pushing battery deployment at scale. GoodLeap and Palmetto are working on a frictionless financial experience for their customers. However, there is still no universal way to connect millions of homes to an energy marketplace.

Molly believes that whoever builds this enabling technology will move mini power plants from the domain of early adopters into the mainstream.

Climate Storytelling: The Power of Framing

Molly and I also discussed why climate storytelling still hasn’t broken through in mainstream media and why business outlets like The Wall Street Journal, The Economist, and The Financial Times often cover climate more effectively than traditional news organizations.

The answer is straightforward: Money. They frame it on the economics.

All are climate stories.

But much of mainstream media still treats climate coverage like eating your vegetables—necessary but flavorless.

Companies make the same mistake. Most people don’t care about batteries—they care about keeping the lights on in bad weather. They don’t care about “grid optimization”—they care about reliability, cost savings, and peace of mind.

The framing makes all the difference.

Why This Conversation Matters

Molly is one of the sharpest minds in climate tech, and this conversation covered a lot of ground:

🔋 Batteries—the backbone of the clean energy future.

⚡ Nuclear fusion—not here yet, but closer than you think.

🏠 Homes as power plants—the next big shift.

🔌 The future of the grid—what’s working, what’s missing.

📊 How many people need to be on board to solve climate change? (Answer: 20%.)

📰 Why CNN was right to kick me out of their building 15 years ago.

🌍 Virtual Power Plants (VPPs)—and the missing fintech layer.

💸 Economics—renewable electrons are the cheapest electrons on the planet.

This is the low-carbon future. It’s not yet evenly distributed, but it is accelerating.

Listen to this podcast episode on Apple, Spotify, YouTube, and all other platforms.

↓

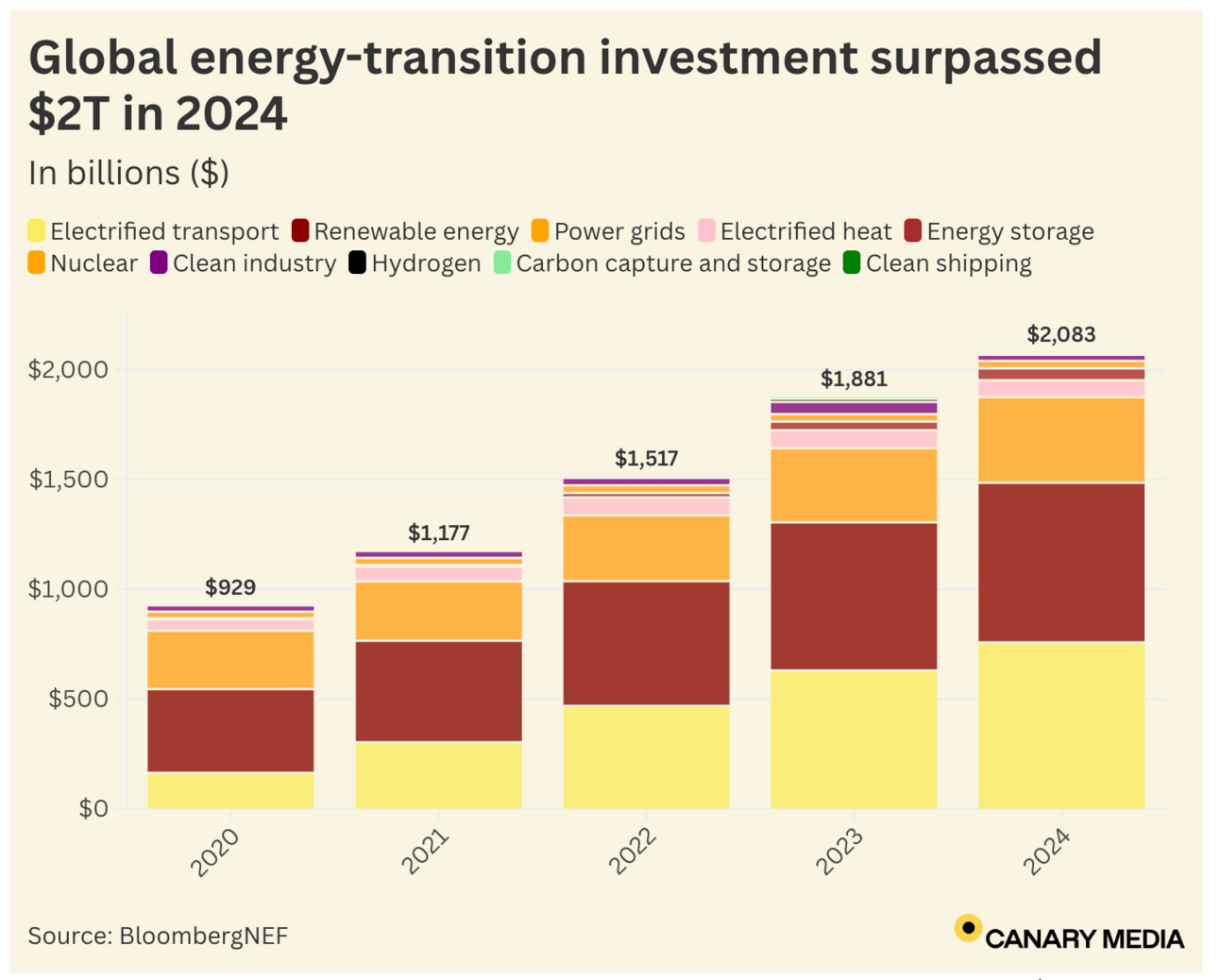

Number of the Week: $2.1 Trillion

That’s the global level of clean energy investment in 2024—doubling in just five years.

Could a shift in U.S. policy curb this growth in 2025? The U.S. accounted for 16% of that total in 2024—$338 billion—so a slowdown would sting.

Still, as an essay in The Wall Street Journal affirmed last week, The Clean Energy Revolution is Unstoppable.

Sources: Bloomberg BNEF and Canary Media

Quote of the Week:

“Where are we with fusion? If I put climate tech on a parallel track to the tech I covered since 1999, we’re at the Nokia brick phone. Maybe even at pagers.”

- Molly Wood, Award-winning tech reporter and Host of Everybody in the Pool

↓

Supercool focuses on proven climate solutions—technologies beyond the pilot phase, scaling commercially across the U.S. and globally. Today, we’re making an exception for nuclear fusion, given Molly’s take on where it stands.

Last October, she interviewed Bob Mumgaard, co-founder & CEO of Commonwealth Fusion Systems (CFS), the world’s largest and most well-funded fusion energy startup. Spun out of MIT in 2018, CFS has raised $2 billion in venture funding to do what sounds like science fiction: create a star inside a bottle—heating plasma to 10 million degrees to generate 100 megawatts of power, the output of a medium-sized power plant.

And that’s just for the pilot proof of concept. The commercial scale version must reach a heat of 100 million degrees.

CFS has soaked up one-third of all fusion venture capital and one-third of the industry’s talent, all racing toward one goal: clean, affordable, limitless energy within the next decade.

Mumgaard put it this way:

“This is something we learned from SpaceX. We have a lot of SpaceX people—three of the first 20, plus another 200 after that. And one of the key things there was the ability to actually go out and build stuff and be sufficiently well enough funded that you could actually punch a problem all the way through.”

CFS isn’t alone. Thirty-nine startups in the Fusion Industry Trade Association are competing to be first, but cooperation is key. The industry still faces regulatory hurdles, public skepticism, and the challenge of scaling supply chains.

The science, experts like Molly will tell you, is largely solved. The remaining barriers? Technology, engineering, and capital deployed on a $10-$20 billion scale.

Fusion won’t power our homes anytime soon. But it’s the most challenging and ambitious tech project in the world and maybe the one that saves it.

↓

Not yet subscribed to Supercool?

Click the button below for weekly updates on real-world climate solutions that cut carbon, improve profitability, and enhance modern life.

🌐