- Supercool

- Posts

- 🌐 Cash Beats Climate: Crowdfunding Millions for Clean Energy

🌐 Cash Beats Climate: Crowdfunding Millions for Clean Energy

In September 2019, I was in the streets of Asheville, North Carolina, with my family for the global climate strikes. My kids held signs. We marched through downtown. We felt the energy, the conviction, the collective determination to do something about climate change.

And then we went home.

That same day, Will Wiseman stood in Barcelona, watching 100,000 people fill Passeig de Gràcia. He'd just completed his second master's degree—this one in Sustainable Energy Technologies from the KTH Royal Institute of Technology in Stockholm.

He was young. He was with his people. He felt a surge of hope. Then the truth. And the despair: everyone was going home, and nothing would change.

"I'm a very pragmatic person," Will told me. "I really saw this as if you get this many people together and their best option is to make a cardboard sign, then there's a glaring problem."

So Will did the unlikely.

He registered an investment platform with the SEC.

The $10 On-Ramp

Climatize enables anyone to invest as little as $10 in renewable energy projects—solar, battery storage, EV charging, energy efficiency—across the United States.

Link your account via Plaid. Pick a project. Earn 6.5% to 12.75% interest while funding infrastructure.

To date: $14 million deployed across 31 projects in 14 states.

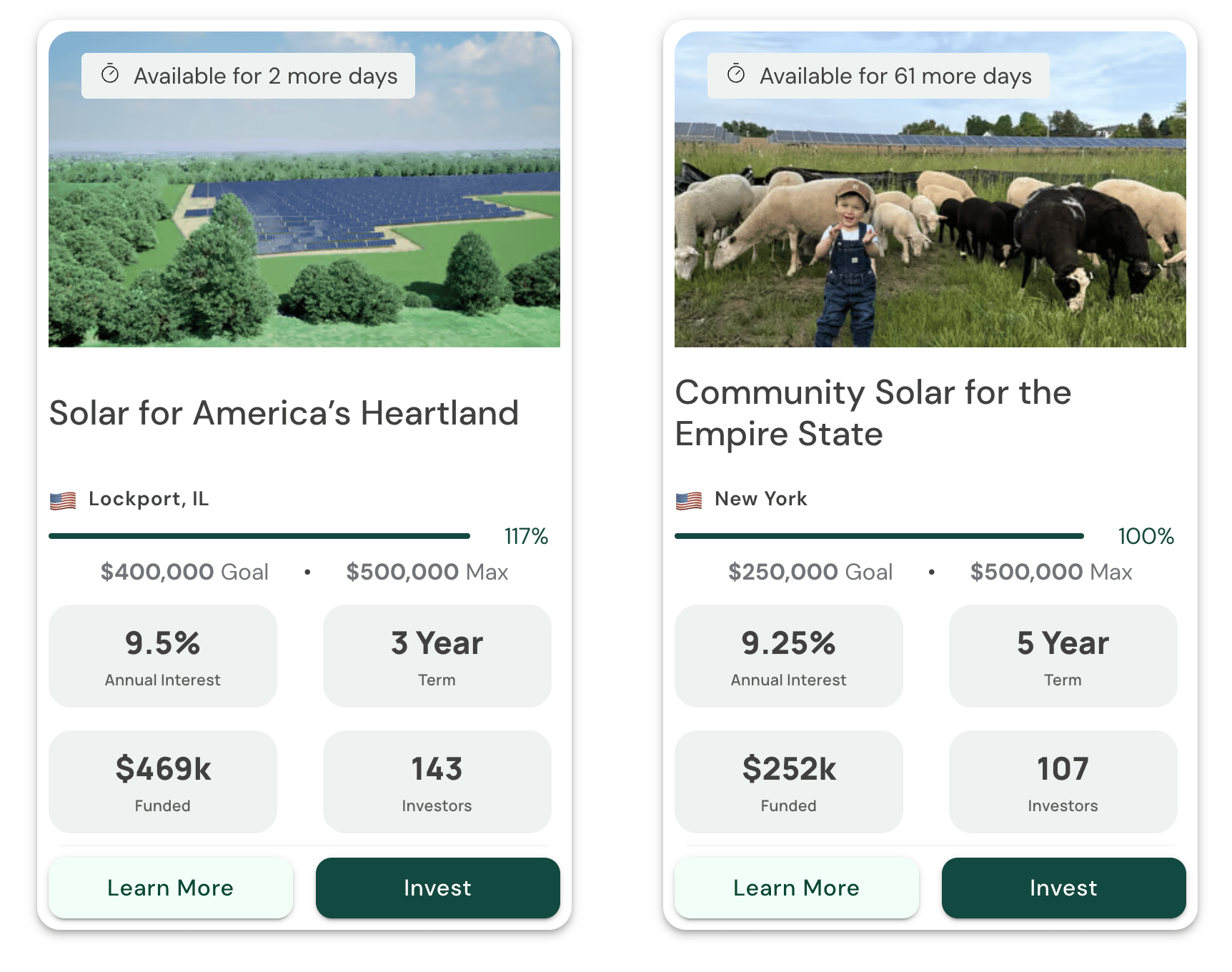

Deals on Climatize’s platform.

Will has been named to the Forbes' 30 Under 30. Fast Company named Climatize to its World-Changing Ideas List. But the numbers and accolades don't tell the full story.

Will is building the foundation for something that scales much, much bigger.

The 100X Surprise

Will built financial models around his millennial peers, assuming they would invest their spare change—$10 here, $100 there. Younger people care more about the climate issue, he reasoned.

He was wrong by 100X—but in the right direction.

The average Climatize account is $50,000. The customer base is predominantly Gen X and younger boomers.

"We originally really thought that the prime user of a platform like Climatize was going to be more your millennial," Will said. "And so we built our first financial models around essentially this idea of what if everybody pitched in a dollar a day."

Three drivers bring investors to the platform.

Financial Returns. Interest rates between 6.5% and 12.75% are competitive with traditional investments.

Values. The climate impact is real, measurable, and meaningful.

Real-World Connection. Projects are visible, locally meaningful, and accessible.

A solar project on a Shakespeare theater in New Jersey

EV charging stations in California

Battery storage in rural Georgia—that kept medicine cold during Hurricane Helene

Investors can physically go and see how their investments accelerate the energy transition and improve lives.

"That is a very meaningful paradigm shift in how people think about investing as something tangible versus intangible," Will said.

But Will quickly saw that when he led with climate and values, fewer investors wrote checks. When he led with returns on tangible projects that also deliver impact, deals started to get fully funded.

The external messaging had to change.

"We, as climate operators, need to get off our hill of climate moral high road and come to terms with the fact that we just need to be pragmatic about how we speak to people on the things that matter to them," Will said.

The $250K-$5M Funding Gap

Projects between $250,000 and $5 million sit in a strategic gap. Too small for Wall Street. Too specialized for community banks.

"You could go get $750,000 to build a commercial real estate building in your town," Will told me. "You would likely struggle to get that same amount of funding for a solar project from that same community bank."

The economics don't work for traditional financial institutions. Due diligence for a million-dollar solar farm—legal review, technical assessment, financial modeling, market analysis, and credit underwriting—costs too much relative to the deal size. On a hundred-million-dollar deal, consulting costs are manageable. On a million-dollar deal, they kill profitability.

Wall Street walks away. Community banks can't underwrite renewable energy.

Climatize built its business model to fill the gap.

Building the Skyscraper Foundation

Will's vision is clear. Fund $1 billion per year in clean energy projects by 2030.

How does a platform that's done $14 million in funding scale to $1 billion in five years?

It starts with infrastructure.

"When you build the foundation of a building, you have to ask, am I building a one-story building in the suburbs or am I building a skyscraper?" Will said, "And so we had to spend time doing that foundation building to be able to process the volume of finance that we want to be able to in the future."

That means building proprietary AI tools that compress due diligence from weeks to minutes. Climatize’s system ingests data rooms, generates credit underwriting memos, prepares legal documents, and conducts research before the company’s first meeting with a developer.

"Historically, what had taken days or weeks now takes us minutes to be able to get to a very, very informed level," Will said. "So that by the time we have that first meeting with the developer, we have all of our legal docs ready. We've got all of the full credit underwriting memo in place."

The Result: Climatize 5x'd monthly deal evaluation capacity.

Million-dollar deals are now economically viable, and Climatize has a speed-to-fund value proposition no one else can match.

One Day vs. Many Months

One community solar portfolio raised $432,000 in five days on Climatize. Another developer raised $185,000 in 24 hours.

"That is just substantially faster than you'll ever get financing from an institution," Will said.

The speed changes developer behavior.

"All of them want to come back and do repeat raises when they have successes like that," said Will. "And they almost don't want to tell their friends about it because then they're worried that they're going to bring other projects and essentially lead to less available capital for them to raise for their projects."

What’s a good signal that your value proposition is winning? Your customers want to keep it a secret.

Now, Climatize had to figure out how to get more capital flowing through its platform.

Right of First Refusal

Climatize’s crowdfunding started with construction finance, providing capital once projects had already been substantially de-risked.

Developers kept asking, "Can you go earlier?"

Development capital is riskier. It comes before construction financing is secured, before permits are obtained, and before key milestones are met. It's also where developers need capital most.

So Climatize adapted.

Early-stage capital grants a right of first refusal in subsequent financing rounds. The venture capital playbook applied to infrastructure.

"We, with our development finance, get right of first refusal for subsequent financing," Will said. "As we develop increasingly complex or mature capital market strategies, we will have additional facilities to be able to support developers across that entire project lifecycle."

That's the path from $14 million to $1 billion.

The Flywheel

Will’s core insight: you don't need millions of micro-investors. You need a strong core group writing meaningful checks.

"If you get a really strong believer core group where they're doing anywhere from $10,000 to $25,000 per project, then it only takes 25 people doing $10,000 a project to have $250K of idle capital ready to go as soon as you launch that project," Will said.

Projects can be fully funded in hours. Developers see speed they can't get anywhere else. And Climatize builds the relationships that enable it to achieve its ambitions.

More successful projects attract more investors. More investors enable faster raises. Faster raises attract more developers. More developers mean better deal flow. Better deal flow strengthens credibility. Stronger credibility enables more sophisticated products.

From $14 million to $1 billion annually in six years.

The crowd is the wedge. Development capital creates the moat. AI makes the economics work. Each piece multiplies the next.

Supercool Takeaway

Climatize weaponized crowdfunding to own the $250K-$5M gap institutions won't touch—where $50K investors fund projects in hours, AI makes small deals profitable, and development capital buys lifecycle control that scales to $1 billion annually.

Operator Takeaways

Speed creates moats. When you fund projects in hours while institutions take months, customers want to keep it secret. That's defensibility.

Build for the end state. AI infrastructure that seems like overkill at $14M in deployment becomes essential for processing $1B annually.

Communicate returns, not values. Climate-first attracted $10 investors. Finance-first attracted $50K accounts. Lead with what closes deals.

This Week’s Podcast Episode

Cash Beats Climate: Crowdfunding Millions for Clean Energy

🎙️ Listen on Apple, Spotify, YouTube, and all other platforms.

↓

Stat of the Week: 72%

Despite headwinds, nearly three-quarters of new U.S. electric power generation built in the first ten months of 2025 was solar. The Federal Energy Regulatory Commission projects 90 gigawatts of solar additions through 2028—enough to push solar's total installed capacity above both nuclear and coal.

Quote of the Week:

I would say, one of the really exciting pieces about a good use case of AI, is suddenly now you can do deals that historically weren't bankable just because of, say, the cost of labor to evaluate an opportunity like that.

↓

Crowdfunding Gives Other Sustainable Companies Their Start Too

Innovators in the low-carbon economy have successfully turned to crowdfunding to raise capital to grow their companies. Where traditional institutions—from banks to VCs—might not understand the business or see how it aligns with their objectives, crowdfunding is filling the gap.

TerraCycle — recycling programs for hard-to-recycle waste

TerraCycle builds take-back and recycling systems for packaging and other “hard” waste streams, often in partnership with major global consumer brands and retailers. It raised $19.5M on StartEngine in 2020 and raised $5M on DealMaker in 2025.

Hempitecture — hemp-based insulation and building materials

Hempitecture makes carbon-negative insulation products from hemp and is scaling into manufacturing and construction supply chains. It raised $4.6M from 1,800+ investors on Wefunder to build capacity and then opened a hemp-insulation production plant in Idaho in 2023.

Fairphone — modular, repairable smartphones built for longevity

Fairphone sells repairable smartphones designed to reduce e-waste and extend device lifetimes through modular parts and long support windows. It raised €2.5M on Oneplanetcrowd in 2018 to stay mission-led and independent, and launched the Fairphone (Gen. 6) in 2025 with modular repairability and 8 years of software support.

BioLite — off-grid energy and cleaner cooking gear

BioLite sells portable stoves, lighting, and charging/power products used both outdoors and in energy-access markets. Its BaseCamp Kickstarter raised $1M+ against a $45K goal, and its 2023 impact report stated it reached 2M additional people that year, bringing total off-grid customers in Africa to 8.1 million.

EcoFlow — portable power stations and home backup systems

EcoFlow sells battery-based power stations and backup power products that often pair with solar panels, positioning them as an alternative to gas generators. It raised $1M on Indiegogo for its RIVER product, then expanded into major U.S. channels, including Home Depot and Amazon.

↓

PODCASTS

The Curious Capitalist: Josh Dorfman (Supercool)

Leading with Optimism: Josh Dorfman on Making Climate Solutions Human, Scalable & Enduring

↓

Interested in Advertising with Supercool?

Connect with future-forward decision-makers seeking next-gen climate innovations. Reach out to discuss how Supercool’s platform can help. Just hit reply to this email.

↓

Not yet subscribed to Supercool?

Click the button below for weekly updates on real-world climate solutions that cut carbon, boost the bottom line, and improve modern life.

🌐